"Sol Prendido" for Borderland Beat

A local investigation of two people’s banking activity helped uncover a massive money laundering conspiracy supported by more than 600 accomplices in the U.S. and Mexico.

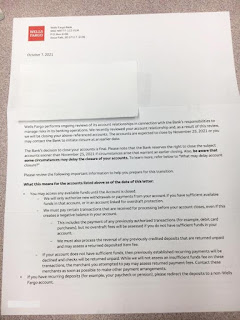

Federal investigators say they uncovered a money laundering scheme involving local Wells Fargo bank accounts, money exchange houses in Nogales, Sonora, and at at least 600 conspirators in the United States and Mexico. Seen here, the Wells Fargo branch in Rio Rico, where even the branch manager was found to be involved in the scam.

In 2018, federal agents based in Nogales received information about potentially suspicious banking activity. Two individuals had received $136,000 in cash deposits over a short period of time, withdrew some of the funds, and wired the rest to Mexico.

Things escalated from there.

According to Scott Brown, special agent in charge of the Phoenix bureau of Homeland Security Investigations, the ensuing probe uncovered a large-scale money laundering scheme supported by more than 600 accomplices in the United States and Mexico.

The network, he said, included at least one local Wells Fargo branch, along with money exchange houses in Nogales, Sonora. The scheme involved cash generated by illegal activity in the United States. The cash was then “funneled” through U.S. bank accounts to Mexico – into the hands of a drug trafficking organization.

Court records say “cash drug proceeds” from 29 states were funneled through 156 accounts at “Wells Fargo Bank in Southern Arizona.” Many of those accounts were opened at the Wells Fargo branch in Rio Rico, whose former branch manager is now serving a federal prison sentence for his role in the conspiracy.

Money laundering schemes are often spread across different states in this manner. But the scope of this investigation – nicknamed “Operation Funnel Cake” by authorities – is significant, according to Brown.

“When you find one funnel account, that almost always leads you to multiple funnel accounts,” Brown told the NI.

“Once we open that door a little bit,” he added, “it very quickly gets kicked much wider open.”

The multi-agency federal investigation of Operation Funnel Cake is ongoing. Meanwhile, those swept up in its net so far – mostly those who played minor roles, as well as a few bigger fish – continue to be prosecuted, convicted and sentenced. Many of those cases are ending up at Santa Cruz County Superior Court, filed by the Arizona Attorney General’s Office.

The defendants’ backgrounds vary: A recent high school graduate, a factory worker in her 30s, a manager at a casino, an elementary school teacher. All were tasked with opening a banking account in Santa Cruz County, through which mid-level operators could make deposits and withdrawals.

Some received financial compensation for operating the funnel accounts; others say they did not.

But regardless of their level of participation, they all played a role in a larger scheme – one that catalyzed illicit drug trafficking.

The role of money laundering

As she sentenced a 60-year-old woman on Monday at Santa Cruz County Superior Court, Judge Liliana Ortega outlined the essential role money laundering plays in empowering drug cartels.

“That’s what makes the drug trafficking organizations work,” Ortega told the defendant, who’d been charged with money laundering in the second degree. “If it weren’t for the money, there wouldn’t be any drug trafficking organizations.”

In a report published earlier this month, a federal commission established by Congress estimated that 100,000 people in the United States died of drug overdoses between June 2020 and May 2021. The commission described synthetic opioids as “a slow-motion weapon of mass destruction.”

Money laundering, the report acknowledged, aids that destruction.

By securing the profits of drug sales and siphoning the cash to cartels, money laundering operations provide financial support to the makers and transporters of opioids, as well as other addictive and deadly drugs.

Now, electronic methods of transferring money – such as wire transfers and cryptocurrency – are presenting new challenges in detecting illicit operations, the commission said.

“Greater efforts,” it said, “are needed to target illegal drug proceeds.”

Local felony cases involving money laundering have risen steadily in recent years.

In 2018, there were four such cases opened at Santa Cruz County Superior Court. That number grew to eight in 2019, then jumped to 13 in 2020 and to 20 last year. So far in 2022, five new money laundering cases have already been filed at the court.

The large majority of the cases filed since 2019 have been presented by the AG’s Office and involve defendants arrested as part of Operation Funnel Cake. In many of the adjudicated cases, the level of the person’s individual culpability was low enough for them to be sentenced to unsupervised probation with credit for time served.

In the past, prosecutors might have been content to merely seize the illicit funds controlled by the low-level participant – focusing on getting criminal convictions against those more deeply involved in laundering money.

But as Santa Cruz County Attorney George Silva pointed out, a new Arizona law signed into effect last May, House Bill 2810, now requires a criminal conviction before a suspect undergoes a civil forfeiture.

In other words, if an individual is caught smuggling cash, prosecutors must convict the person – proving the money was connected to a crime – before permanently confiscating any related items.

That, Silva said, could be contributing to a rise in criminal prosecutions for money laundering.

Speaking to the NI on Wednesday, Brown acknowledged that not all 600 participants identified by Operation Funnel Cake – who span two countries – will be prosecuted.

He added that regulations can be “equally, if not more impactful” than arrests when it comes to deterrence. For example, requiring identification for a counter deposit exceeding a certain sum, he said, can provide an effective preventative measure.

‘On the inside’

One facet that allowed Operation Funnel Cake to flourish was “having somebody on the inside at a bank,” Brown said.

In this case, that insider was Carlos Vasquez – a former manager of the Wells Fargo branch in Rio Rico. Vasquez was charged with conspiracy to commit money laundering between 2017 and 2019; prosecutors alleged that during that time frame, Vasquez knowingly authorized $357,883 in illegal wire transfers through funnel accounts.

Within those two years, the government alleged, the money laundering organization moved about $10.5 million through the Rio Rico bank and into Mexico.

Vasquez was charged at federal court in Tucson. He later pleaded guilty and, in September 2021, was sentenced to 30 months in prison.

He was one of many conspirators.

In June 2021, Maria Concepcion Gonzalez Garcia was sentenced to 2.5 years in prison for recruiting people in Nogales, Sonora to open funnel accounts for payment. And in August 2020, Enrique Monarque Orozco, a business owner in Nogales, Sonora, received the same sentence in state prison for paying and assisting people in opening the accounts.

Monarque was also charged with federal crimes stemming from the scheme. He pleaded guilty in May 2021 and is awaiting sentencing at U.S. District Court in Tucson, scheduled next month.

Still other key operators are identified in court records analyzed by the NI. For example, “M.E.E.” is described in one case as a woman meeting funnel account owners at a Nogales McDonald’s.

Others could be living in Mexico. Brown acknowledged that Mexican law enforcement faces challenges in detaining money laundering facilitators. In a previous interview with the NI, Brown referenced the flow of illegal firearms into Mexico and stressed the importance of law enforcement not becoming “outgunned by the cartels.”

Still, Brown added, Mexican law enforcement acts as a helpful partner to U.S. investigations “where they can safely do so.” Extraditions to bring money laundering operators to the United States for trial, he added, are also an option, though the U.S. government must first build a strong case.

Smaller players

On Jan. 18, a dark-haired, 37-year-old woman stepped up to the podium before Judge Thomas Fink at Santa Cruz County Superior Court. Moments before receiving her sentence, she apologized for her participation in the money laundering operation.

Court documents show that in the spring of 2017, the woman opened a funnel account at a Wells Fargo in Nogales. (The documents do not specify which branch.) Over a one-year period, more than $228,000 moved through the account.

The woman was reportedly paid $40 to $50 for each wire transfer she conducted.

“It fills me with embarrassment,” she said, speaking through a court interpreter. “I ask for the opportunity to be with my children again.”

Court records also show the woman was living with notable financial strain. When she was arrested, she’d been working 12-hour shifts for a manufacturing plant – a maquiladora – in Nogales, Sonora. The job paid $84 a week. On the side, the woman bought and resold clothes at a swap meet.

She’d heard about the money laundering opportunity – and the chance to make extra money – through a man at the maquiladora.

So, she opted in.

In January, the woman was sentenced to three years of probation; she also served 71 days in jail.

In most recent cases analyzed by the NI, defendants received a similar sentence: three years of unsupervised probation, along with credit for the several months of jail time served prior to sentencing. Those who are not U.S. citizens will also likely suffer the permanent loss of the their border-crossing privileges.

That same morning, a young man’s aunt stepped up to the podium. Speaking to the judge, her voice breaking, she described her nephew as a man intent on caring for his family.

“He’s a very hardworking young man. Healthy. He doesn’t use drugs, he doesn’t drink,” she added.

In 2018, the young man, still a teenager, graduated from high school. He’d started a management position at a local restaurant.

And, that year, he also opened a checking account at Wells Fargo – on behalf of a friend, he told investigators. Within just a month in the spring of 2018, $70,060 was deposited into the account.

Several themes weave themselves through these cases. A McDonald’s in Nogales, Ariz. was used as a meeting or recruiting spot. Many low-level participants told investigators they did not know who was depositing money into the funnel accounts they’d opened.

And “casas de cambio” – money exchange houses that convert dollars to pesos – play a consistent role in the operation.

In one document, investigators describe the funnel account owners as “hired by various casa de cambios in Nogales, Sonora.” Two of the cases examined by the NI involved casa de cambio employees who were directed to move cash for the operation.

Brown also cited a “culture” of having recruiters in Mexico work in affiliation with banks and money exchange houses there. Some of those recruiters, Brown said, could be working with illicit businesses – like drug trafficking organizations – to reroute money.

Ramifications

Late last year, a Wells Fargo client living in Mexico received a letter saying that their account would be closed. The letter was shared with the NI.

Since then, multiple people living in Mexico have reported similar findings – that their bank accounts at U.S. Wells Fargo branches will soon be declared null and void.

It’s a new policy being applied across the board. In a statement, a Wells Fargo spokesperson said the bank is reaching out to clients who do not meet “new residency requirements for consumer deposit accounts.”

“For those (account holders) who are not able to provide a valid primary residential address located in the U.S. or its territories, we will ask that they close the account,” the statement said.

The statement did not mention the money laundering scandal as a factor in its new policy.

One Wells Fargo customer told the NI she had until March to close her account. The woman, who does not have a U.S. address, said she’d become accustomed to using the account for her travels within the United States, particularly when paying at gas stations and hotels.

Another woman said that while she lived in Sonora, she visited Arizona to see family members and shop; using the account was a convenience for her.

In years past, law-abiding community members have paid the price for other people’s money laundering activities.

In 2014, JPMorgan Chase&Co. began limiting its foreign business accounts to better follow federal anti-money laundering regulations. Later, the Chase branch on Grand Avenue closed altogether.

Other banks – including Banamex, Bank of America and Sunrise Bank – have closed branches in Nogales within the past decade for varying reasons.

The stream of closures drew outcry from then-U.S. Sen. John McCain, who pressed for an investigation into why banks were closing along the Arizona-Sonora border.

One bank that maintained its local operations was Wells Fargo, which has two branches in Nogales and one in Rio Rico.

In a pre-sentencing memorandum filed on behalf of Carlos Vasquez, the former branch manager in Rio Rico, his defense lawyer insisted that Vasquez never saw any personal financial gain from his crimes, and instead was motivated by the sales-first culture at Wells Fargo.

The defense lawyer, Joshua Hamilton, described how some banks had closed operations along the border due to pressure from government over money laundering concerns. But Wells Fargo remained, giving it an “outsized presence” in and around Nogales, he wrote.

“As an institution, it was underprepared (or unwilling) to combat money laundering, in contrast to its competitors,” Hamilton argued. But in their own memo, federal prosecutors countered that the corruption appeared to be particularly concentrated at the Rio Rico branch, and asserted that Vasquez was responsible for creating his own culture of looking the other way.

Wells Fargo said it was unable to make a representative available to comment on the illegal activity uncovered by Operation Funnel Cake.

Brown acknowledged that a bank’s decision to close is a business choice. However, he added, “I would never say, ‘Don’t have a bank in Nogales, in Douglas.’”

Instead, he advocated for deliberate anti-money laundering controls.

“I think (banks) can take steps to make sure that you are doing banking smartly in those communities,” Brown said. “And frankly, as a person that loves those communities, I hope you are.”

.webp)

Need a 100billion $$$ boost to budgets and 10K new cracker-jack agents to round-up these out-of-luck $$$launderers!

ReplyDeleteToo funny!

Not really little nuts Flame Thurther.

DeleteFunnel Cakes Lives Matter!

ReplyDeletePowdered sugar can't breathe!

DeleteThe Ugly woman in the pic looks like Rambo's mom

DeleteBlack lives matter

ReplyDeleteWe like to follow killers and dead people on this site.... y sales con tu chingaderas.... We are Mexican so the only blacks are Hiatians and Cubans in Mexico....No welfare system no government handouts... as que chingale para tragar.

Delete10:40 haitians and cubans in mexico are very quiet and dont do problems

Delete@10:40 am. Stop being a brainwashed, racist idiot and do some reading. White people in red states plus corporations are the biggest deadbeats and leeches in the US. Donald Trump handed over $12 billion in free money to mostly white farmers. Big Pharma companies have oceans of cash, yet much of their research gets funded by the US taxpayers vida the National Institute of Health.

DeleteElon Musk has received billions in subsidies-ie welfare- from US taxpayers. You as a Mexican ought to know better than to believe white people's lies about black people.

Thanks

Delete10:40 no gov handouts my ass. Your gov hands out televisions and microwave ovens for VOTES!

Delete12:23 He is one of the Dumb ones...Very likey Ugly too

Delete9:08-Thats political parties not an establish government program that gives out small appliances to the poor

Delete12:23 What that has to do with any Narco news...Yes I do have a Tesla

11:57 As they should as a non-national their rights are different. Same as a non citizen can be removed from the US

All these WOKIES are very emotionally disturbed

The tittle says it all--Blog dedicated to reporting on Mexican drug cartels on the border line between the US and Mexico. Does not say Blog for NAACP or related issues....

DeleteAbortion kills more black babies every week than law enforcement ever has period.

ReplyDeletePobrecito babies. Do their lives matter Kamala and Al Sharpon?

That's pointless

DeleteForfeited money and pokey time.

ReplyDeleteMmmmm funnel cake

ReplyDeleteI’m traveling for work and find myself in Eugene, OR - Tracktown USA. This is the only city I’ve been to in over a decade where the Taco Times (est. 3 locations) are thriving, neon-sign lit, establishments. Every other city I visit or have lived in has either closed-down buildings , or run-down buildings, as their Taco Time franchisees. I’m assuming these Eugene Taco Times are part of a complex laundering network.

ReplyDelete