Scams Targeting U.S. Victims Produce Significant Revenue for CJNG

WASHINGTON—Today, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned four Mexican individuals and 13 Mexican companies linked to timeshare fraud led by the Cartel de Jalisco Nueva Generacion (CJNG). These individuals and companies are based in or near Puerto Vallarta, a popular tourist destination that also serves as a strategic stronghold for CJNG. A brutally violent cartel, CJNG is a U.S.-designated Foreign Terrorist Organization (FTO) that is increasingly supplementing its drug trafficking proceeds with alternative revenue streams such as timeshare fraud and fuel theft.

“We are coming for terrorist drug cartels like Cartel de Jalisco Nueva Generacion that are flooding our country with fentanyl,” said Secretary of the Treasury Scott Bessent. “These cartels continue to create new ways to generate revenue to fuel their terrorist operations. At President Trump’s direction, we will continue our effort to completely eradicate the cartels’ ability to generate revenue, including their efforts to prey on elderly Americans through timeshare fraud.”

Treasury has taken a series of actions targeting the diverse revenue streams benefitting the cartels, including fuel theft, human smuggling, extortion, and fraud. As Treasury and its partners seek to disrupt the cartels’ revenue streams, it is important to remind current owners of timeshares in Mexico: If an unsolicited purchase or rental offer seems too good to be true, it probably is. Those considering the purchase of a timeshare in Mexico should conduct appropriate due diligence.

Today’s action was taken pursuant to Executive Order (E.O.) 14059, which targets the proliferation of illicit drugs and their means of production, and pursuant to E.O. 13224, as amended, which targets terrorists and their supporters. Today’s action was also taken in coordination with the Federal Bureau of Investigation (FBI), the Drug Enforcement Administration (DEA), and the Government of Mexico’s financial intelligence unit, the Unidad de Inteligencia Financiera (UIF).

CJNG: VIOLENCE IN PURSUIT OF PROFIT

CJNG is considered one of the most powerful cartels in the world. It has conducted intimidating acts of violence, including attacks on the Mexican military and police with military-grade weaponry, the use of drones to drop explosives on Mexican law enforcement, and assassinations and attempted assassinations of Mexican officials. CJNG has also executed its own recruits who defy orders. All of this is perpetrated in furtherance of CJNG’s relentless pursuit of illicit proceeds. In addition to drug trafficking, the group’s core source of revenue, CJNG is also generating alternative revenue streams through fuel theft, extortion, and timeshare fraud, among other activities.

On April 8, 2015, OFAC designated CJNG pursuant to the Foreign Narcotics Kingpin Designation Act (Kingpin Act) for playing a significant role in international narcotics trafficking. On December 15, 2021, OFAC also designated CJNG pursuant to E.O. 14059. On February 20, 2025, the U.S. Department of State designated CJNG as an FTO and a Specially Designated Global Terrorist (SDGT).

PARADISE LOST: TIMESHARE FRAUD IN MEXICO

Mexico-based cartels have been targeting U.S. owners of timeshares through call centers in Mexico staffed by telemarketers fluent in English. Beginning in about 2012, CJNG took control of timeshare fraud schemes in Puerto Vallarta, Jalisco, Mexico, and the surrounding area. These complex scams often target older Americans who can lose their life savings. The lifecycle of these scams can last years, resulting in financial and emotional devastation of the victims while enriching cartels like CJNG.

The cartels generally obtain information about U.S. owners of timeshares in Mexico from complicit insiders at timeshare resorts. After obtaining information on timeshare owners, the cartels, through their call centers, contact victims by phone or email and claim to be U.S.-based third-party timeshare brokers, attorneys, or sales representatives in the timeshare, travel, real estate, or financial services industries. The fraud may include timeshare exit scams (a.k.a. timeshare resale scams), timeshare re-rent scams, and timeshare investment scams. The common theme is that victims are asked to pay advance “fees” and “taxes” before receiving money supposedly owed to them. This money never comes, and the victims are continuously told to pay additional “fees” and “taxes” to finalize the transactions. Victims are typically told to send these “fees” and “taxes” via international wire transfers to accounts held at Mexican banks and brokerage houses. After these initial scams, re-victimization scams can occur. The scammers may impersonate law firms, claiming that they can initiate proceedings on behalf of the victims to recover lost funds for an upfront fee. In other instances, scammers impersonate government officials, including OFAC, claiming that victims have engaged in suspicious transactions and demanding “fines” to release their funds or face the risk of imprisonment.

On July 16, 2024, Treasury’s Financial Crimes Enforcement Network (FinCEN), OFAC, and the FBI issued a joint Notice on timeshare fraud associated with Mexico-based transnational criminal organizations (TCOs), including in Spanish, to provide financial institutions with an overview of these schemes, associated financial typologies, and red flag indicators. In the six-month period following this Notice, FinCEN received over 250 Suspicious Activity Reports, and filers reported approximately 1,300 transactions totaling $23.1 million, sent primarily from U.S.-based individuals to counterparties in Mexico. Based on FinCEN’s analysis, U.S. fraud victims sent an average of $28,912 and a median amount of $10,000 per transaction to the suspected scammers potentially working for Mexico-based TCOs.

According to the FBI, approximately 6,000 U.S. victims reported losing nearly $300 million between 2019 and 2023 to timeshare fraud schemes in Mexico. In 2024 alone, FBI’s Internet Crime Complaint Center (IC3) received nearly 900 complaints concerning timeshare fraud schemes in Mexico with reported losses of over $50 million. However, these figures likely underestimate total losses, as the FBI believes the vast majority of victims do not report the scam due to embarrassment, among other reasons. On its website, the FBI has included a timeshare fraud resource page, and FBI’s New York Field Office has posted a public service announcement video featuring a victim of timeshare fraud. Victims of timeshare fraud are encouraged to file a complaint with the FBI’s IC3 by visiting https://www.ic3.gov. For elder victims, financial institutions may also refer their customers to the Department of Justice’s National Elder Fraud Hotline at 833-FRAUD-11 (or 833-372-8311).

TARGETING TIMESHARE FRAUD

Today’s action marks the fifth time OFAC has sanctioned those linked, directly or indirectly, to CJNG’s timeshare fraud activities, resulting in the designation of over 70 individuals and entities to date. The previous actions occurred on March 2, 2023, April 27, 2023, November 30, 2023, and July 16, 2024.

The three senior CJNG members most involved in timeshare fraud are Julio Cesar Montero Pinzon (Montero), Carlos Andres Rivera Varela (Rivera), and Francisco Javier Gudino Haro (Gudino). These three individuals have also been part of a CJNG enforcement group based in Puerto Vallarta that orchestrates assassinations of rivals and politicians using high-powered weaponry.

On June 2, 2022, OFAC designated Montero pursuant to E.O. 14059. Today, Montero is being designated pursuant to E.O. 13224, as amended, for being directed by, or having acted or purported to act for or on behalf of, directly or indirectly, CJNG.

On April 6, 2021, OFAC designated Rivera and Gudino pursuant to the Kingpin Act. Today, Rivera and Gudino are being sanctioned pursuant to E.O. 14059 and pursuant to E.O. 13224, as amended, for being directed by, or having acted or purported to act for or on behalf of, directly or indirectly, CJNG.

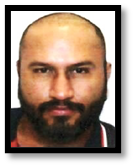

The other individual sanctioned today is Puerto Vallarta native Michael Ibarra Diaz Jr. (Ibarra). An ostensibly legitimate businessman involved in the tourism industry, Ibarra is engaged in timeshare fraud on behalf of CJNG. For over 20 years, Ibarra has been involved in the sale and management of timeshares in the Puerto Vallarta area, including just north in the state of Nayarit. Ibarra was trained as an accountant, which is consistent with CJNG’s use of professionals to conduct this complicated and highly lucrative scheme. Ibarra is being sanctioned pursuant to E.O. 14059 and pursuant to E.O. 13224, as amended, for being directed by, or having acted or purported to act for or on behalf of, directly or indirectly, CJNG.

Also sanctioned today is Ibarra’s corporate network, which is composed of 13 companies. Five of the companies—Akali Realtors, Centro Mediador De La Costa, S.A. de C.V., Corporativo Integral De La Costa, S.A. de C.V., Corporativo Costa Norte, S.A. de C.V., and Sunmex Travel, S. de R.L. De C.V.—explicitly acknowledge their involvement in the timeshare industry. Another company involved in timeshare-related transactions—TTR Go, S.A. de C.V.—claims only to be a travel agency.

Also sanctioned today is Ibarra’s corporate network, which is composed of 13 companies. Five of the companies—Akali Realtors, Centro Mediador De La Costa, S.A. de C.V., Corporativo Integral De La Costa, S.A. de C.V., Corporativo Costa Norte, S.A. de C.V., and Sunmex Travel, S. de R.L. De C.V.—explicitly acknowledge their involvement in the timeshare industry. Another company involved in timeshare-related transactions—TTR Go, S.A. de C.V.—claims only to be a travel agency.  Three additional companies are purportedly engaged in real estate activities: Inmobiliaria Integral Del Puerto, S.A. de C.V., KVY Bucerias, S.A. de C.V., and Servicios Inmobiliarios Ibadi, S.A. de C.V. This diverse corporate network also includes tour operators (Fishing Are Us, S. De R.L. de C.V.; Santamaria Cruise, S. de R.L. de C.V.), an automotive service company (Laminado Profesional Automotriz Elte, S.A. de C.V.), and an accounting firm (Consultorias Profesionales Almida, S.A. de C.V.). These 13 companies are being sanctioned pursuant to E.O. 14059 and pursuant to E.O. 13224, as amended, for being owned, controlled, or directed by, or having acted or purported to act for or on behalf of, directly or indirectly, Ibarra.

Three additional companies are purportedly engaged in real estate activities: Inmobiliaria Integral Del Puerto, S.A. de C.V., KVY Bucerias, S.A. de C.V., and Servicios Inmobiliarios Ibadi, S.A. de C.V. This diverse corporate network also includes tour operators (Fishing Are Us, S. De R.L. de C.V.; Santamaria Cruise, S. de R.L. de C.V.), an automotive service company (Laminado Profesional Automotriz Elte, S.A. de C.V.), and an accounting firm (Consultorias Profesionales Almida, S.A. de C.V.). These 13 companies are being sanctioned pursuant to E.O. 14059 and pursuant to E.O. 13224, as amended, for being owned, controlled, or directed by, or having acted or purported to act for or on behalf of, directly or indirectly, Ibarra.

SANCTIONS IMPLICATIONS

As a result of today’s action, all property and interests in property of the designated or blocked persons described above that are in the United States or in the possession or control of U.S. persons are blocked and must be reported to OFAC. In addition, any entities that are owned, directly or indirectly, individually or in the aggregate, 50 percent or more by one or more blocked persons are also blocked. Unless authorized by a general or specific license issued by OFAC, or exempt, OFAC’s regulations generally prohibit all transactions by U.S. persons or within (or transiting) the United States that involve any property or interests in property of blocked persons.

Violations of U.S. sanctions may result in the imposition of civil or criminal penalties on U.S. and foreign persons. OFAC may impose civil penalties for sanctions violations on a strict liability basis. OFAC’s Economic Sanctions Enforcement Guidelines provide more information regarding OFAC’s enforcement of U.S. economic sanctions. In addition, financial institutions and other persons may risk exposure to sanctions for engaging in certain transactions or activities involving designated or otherwise blocked persons. The prohibitions include the making of any contribution or provision of funds, goods, or services by, to, or for the benefit of any designated or blocked person, or the receipt of any contribution or provision of funds, goods, or services from any such person.

Furthermore, engaging in certain transactions involving the persons designated today may risk the imposition of secondary sanctions on participating foreign financial institutions. OFAC can prohibit or impose strict conditions on opening or maintaining, in the United States, a correspondent account or a payable-through account of a foreign financial institution that knowingly conducts or facilitates any significant transaction on behalf of a person who is designated pursuant to the relevant authority.

The power and integrity of OFAC sanctions derive not only from OFAC’s ability to designate and add persons to the Specially Designated Nationals and Blocked Persons List (SDN List), but also from its willingness to remove persons from the SDN List consistent with the law. The ultimate goal of sanctions is not to punish, but to bring about a positive change in behavior. For information concerning the process for seeking removal from an OFAC list, including the SDN List, or to submit a request, please refer to OFAC’s guidance on Filing a Petition for Removal from an OFAC List.

Click here for more information on the persons designated today.

###

El plumas tiene los corridones mas perros alv ... Don Nemesio is king !!!

ReplyDeleteConnor get a job, it's good to stay busy, get a job.

DeleteChar Stalker

Connor has a tramp stamp.

DeleteRey de un maricon (connor). Nuff said.

DeleteNegative chief.

Delete302 pm my bitcoin just went up to 122k today from 21k during the pandemic. Im good chief . Lmao I suggest you invest some billete in stocks.

DeletePinchi Connor es un vato cachondo a la verga quiere besar al Char, Emma Coronel, Kristi Noem, TODOS de las cuatro letras, Donnie y Pam Bondi. Ese vato borracho y periqueado es un problema. Ay mamá...

Delete944pm hahhaha tuvo buena esa pa... pa que le digo que no si si alv

Delete7:43 dile connor 'a limpiar cagaderos gringos' esa es buena la NASA anda estudiando la mente del bato pero encontro puro kristal y canciones de maluma

DeleteRIP Gilbertona

9:44 seas mamon! Connor nomas busca una riata! Y es un chetillo todo jodido, su nombre todos lo savemos.😂😂

Delete9:44 Connor nomas se pone cachondo con el chetillo de Trump, a como le gusta la VRG a Connor

DeleteInvest in QQQm if you want to make some extra money. Stay away from crypto.

Delete9:44

DeleteY cuando se pone bien foco le pega unas violadas a las almohadas. Pinche vato maniaco.

Pfff stocks … Come on Connor is this 1999 ?? Forex is where it’s at buddy .. has been for years.. took me 3yrs to grow a $10,000 dollar portfolio to $634,000… and I’m no pro .. but advising people to invest in stocks and bitcoin, is like telling kids to stay in school .. Connor your an idiot

Delete6:30

DeleteForex? Don't you read BB? Invest in the drug trade, super quick returns, all cash money, too! Only downside is being beheaded or getting thrown in prison.

630 pm bitcoin under 120k at the moment is a steal if u can afford it bought at 20k to 21.5k during the pandemic 2020 .. now tell me an idiot hahahha .

Delete@ Connor .. you an idiot if you don’t sell now !

Delete@ Connor: "Now tell me an idiot". Tell you an idiot? He gets investment presents from wealthy family members and pretends he made the investment himself, and he calls people chief. I'll give you 3 guesses who I'm talking about, you'll probably need them.

DeleteUs always in everyones business except fixing the shithole it’s turning into

ReplyDeleteLol that timeshare shit is slow money, the real guy that actually brought that method to Jalisco was killed soon as he gave the game back in the day.

ReplyDeleteWho was that guy?

DeleteWho was that

Delete@2,04 am. Fraudsters have been doing it for years all over Mexico, nobody was killed after "bringing the method" to Jalisco. There are dozens of methods, sounds like the dude at 3.53 is exaggerating stories of financial experts are considered to know too much once they are no longer needed. It does happen, but there wasn't one man, or one method.

DeleteAnd as always the corrupt, incompetent Mexican “authorities” do absolutely nothing on their own.

ReplyDeleteNot capable of producing income via legal means.....what a bunch of weak limp wristed pussies.

ReplyDeleteFor real .. can’t even move drugs like really traffickers do, so they resort to scamming and stealing .. poor little Jaliskas although according to some faggot here on BB michoacan 🦋 tells Jaliskas what to do 🤷♂️

DeleteCartels are a creation from the millions of junkies on the gool ol US of A. Thank them for suplying your fix

DeleteThey may be sadistic murderers but if you think la Firma and Gallina - the second 2 - are limp wristed pussies you have no idea who they are or what they do. You think the daylight attack on Garcia Harfuch in Mexico City was a limp wristed thing to do attempt? Time share fraud for them is like the most pyschopathic, violent, reckless and dangerous men in the US playing slot machines on a Monday lunch break. Fuck em, I hope they die as I type, but some of the insults on here just fall so flat it shows the commenter doesn't know who they're talking about. (El Gordo is a skinny bitch, Flaco is a fat ass...".

DeleteTreasury should start with the Moon Palace in Cancun for timeshare fraud.

ReplyDeleteAnimo Señoron Trump!

ReplyDeletePronto veran los blackhawk de la CIA exterminando a los carteles .

623pm that's a negative chief

DeleteCuando pinche connor tiene razon es porque la cagaste por completo. Ese 6:23 puro alucin gringo maniaco

DeleteConnor usta be cool.

DeleteHe came up with some useful info from his "contactos".

Now, because people insult him, he thinks he has a following, a "Connor Nation", and has the delusional urge to out-nuff the Nuff, and post non-stop nonsense willynilly.

Mental illness?

Substance abuse?

Narcissism?

...or maybe an anguished combination of all three.

If I had a heart, it would certainly goe out to him... 😅

Callese alv Connor metiche chupa pitos

DeletePuro Connor Nation!!!

Delete8:51 Damn you jealous of this fucking Connor? Because he's being insulted? Really weird comment. 'Connor Nation' chingada madre . . .

Delete@8.51. Connor was never cool. His "contactos" are the same contacts everybody old enough to know how to navigate the internet have.

DeleteOFAC is going after the Billboard hits singing about Plumas? Scott Bessent got an eye on Luis R and Neton Vega .

ReplyDeleteIf you're so stupid that you give your money away over the phone, how were you smart enough to gather together the dinero to begin with? 🤔

ReplyDeleteA lot of drug traffickers in usa posing as realtors or contractors. Especially in Arizona and Texas

ReplyDeleteUncle sam want his cut $$$

ReplyDeleteI am contacting you to see if you are interested in publishing an article about the mafia of Judges in the Mercantil number 3 courthouse in Cancun, Mexico that have organized to change the titles in the Registry of Deeds of foreign owned real estate into the names of lawyers that work with them?

ReplyDeleteI am a victim of this fraud, in that a lawyer gets to know a client, then when he knows that the client will be away for a few months, he presents a huge false debt with a forged signature that looks somewhat like his clients signature, to the judge who then does a superfast trial and within 30 days the property is attached without the foreigner knowing anything. They then proceed to try to change the title at the Registry of Deeds. And the entire case is kept secret in that it does not appear on the Internet Register of Civil Demands. The entire courthouse number 3 is implicated from secretary to Actuario (who does the false notifications) and several workers who are responsible to follow the law and publish the demand in the Courthouse Internet Website. And of course the judges themselves.

The lawyer who is trying to scam me out of a penthouse worth 400,000USD has now 5 more criminal cases open against her in the criminal court from foreigners for the same scam of forged loan papers, and due to them being corrupt as well, the police do nothing to investigate the foreigner's complaints or to stop her from finding more victims.

I have all the documentation on this as I have hired 3 lawyers in Cancun, plus the Mexican buyer of my penthouse has a friend who is a Government Prosecuting Attorney who is facilitating the inside information. But this is only one of a number of lawyers who are carrying out this scam in Cancun and the Riviera Maya.

It is your duty to investigate this and expose it, and we will facilitate all the information, to protect other foreigners from falling victim to the corrupt Court Mercantil N3.

There is also the case in Tulum of an American citizen Eric Rockenbach, who was a successful villa developer, who was found with a gunshot through his heart, just as he had sold out a villa project and had amassed more than 10,000,000 USD in his Mexican bank accounts. He was found dead exactly one year ago. An eyewitness who saw the body in the morgue, his ex girlfriend, saw that both of his eyes had been gouged out. Yet the Mexican police ruled it a suicide, in that he first gouged both of his eyes out, then he shot himself in the heart, because he left a suicide note.

A prominent local Mexican politician is now appearing in the press with his ex partner and a girlfriend, as they have taken over his +10,000,000$ bank accounts.

Please look Eric up on Google.

Are you interested in the detailed information about these cases? Mine, the other 5 foreigners who are victims of this lawyer, and Eic Rockenbach,

2:07

DeleteWho are you directing your comment to.🤔

Humm bug...

Perhaps Connor

Nuffy Said

No period kid

SIR

Rubio NYC

Snitcher Truther snitched

James Brown

Lizard man

No foreigner in his right mind should ever trade perfectly good $ currency for a piece of paper with some mesican writing on it saying that you own property down south.

DeleteIt's all a scam.

Kiss that $10,000,000 goodbye! 💰🥹

That's Koo foo

Delete11:29

DeleteMaybe for Koo Foo or Midget Mijo... Could be 006 if he wasn't so busy protecting El Señor Ivan

Hummbug is KING!!!

Delete👑

That's true.. whatever happened to Midget Mijo?

Delete@2.07. Ignore the kids, but Borderland Beat aren't investigative journalists, they're unpaid volunteers, and they have zero "duty" to investigate anything you say, no matter how much documentation you have. If you can pay them a wage that would justify the risk of exposing a Judicial conspiracy with CJNG then email them, but it should cost you more than you lost, because any real investigation would expose them.

DeleteHard to believe timeshares even exist nowadays. These have been ripp-offs from the start, yet people still get suckered into signing an agreement that's all but impossible to get out of unless hire a lawyer.

ReplyDeleteSounds personal huh?

DeleteTime share dummy.

@10.57. Fake Nuffy burps again.

DeleteMexico and many countries are experiencia inflación y big increase in real Estate price. Soon it will be too expensive for anyone to live in this World and thats the plan by the rich people who control this planeta. We are all their slaves

ReplyDelete422

DeleteSomebody like you will ALWAYS be somebody's slave, foo!

How do you think people like me prosper? 😅

Por ser ratero, sapo, padrote y mañoso.

ReplyDeleteU guys do know el plumas es mencho right,right??

ReplyDelete